Becoming a Finance Director is the aspiration for many qualified accountants. Once reached, the question then becomes “how do I become a better FD?”

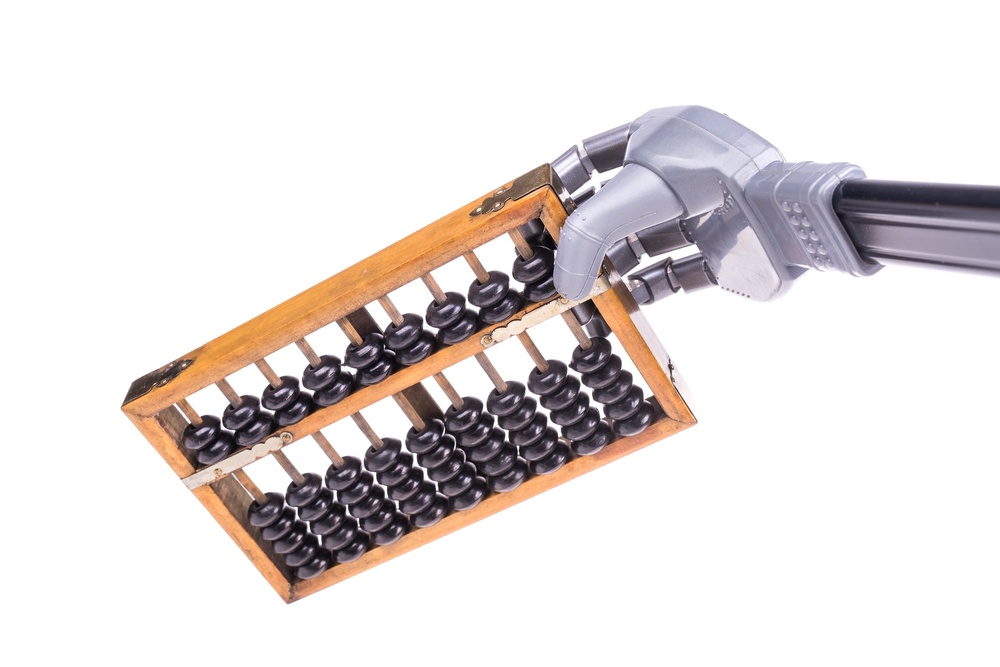

Finance directors of tomorrow see the application of technology as a necessary condition for growth; no longer are the traditional models sufficient.

In this blog, we explore why technology is a core component of the ever-expanding role of the modern FD and why this transformation has broken the constraints imposed by the historical composition of the department.

Becoming tomorrow’s FDs: What is a tech-enabled FD?

Traditionally, a ‘good’ accounting and finance environment meant having a strong finance team, well-structured controls, and access to management reporting. However, with the current rate of technological progress showing no signs of abating, this is no longer sufficient.

Whilst the role of AI, machine learning and automation are crucial cogs in the whirling machine of the modern finance department and powerful weapons in the arsenal of the modern FD, we will for now focus on business insights.

Related article| Will Accounting AI reshape the finance function?

Businesses, and finance teams by extension, must be able to look forward as well as behind. Finance directors need to have an accurate forecast of the next six months, a clear plan for the next 12 months and a reasonable idea of where the company will be in the next three years.

Since the rate of decision-making is increasing in parallel with technological advancements, faster access to business insights has never been more important, and the tech-enabled FD more in demand.

To meet the present and future needs of the business, the following must be a constant and evolving process

- Real-time extraction and presentation of data.

- Remodelling various scenarios.

- Updating existing assumptions.

- Creating new KPIs.

Providing business insights for FDs and CFOs

Historically, the accountant’s tool of choice has been Excel.

However, with Excel prone to human error and the advent of cloud-based software, the days of grinding through data on spreadsheets and making manual manipulations to clean, use and interpret data are long gone.

Related article | Video: Operational insights

Since requirements constantly change, a more secure delivery mechanism combined with self-service interactivity is often needed.

Software such as Microsoft Power BI automates processes and allows the user to connect, visualise and interpret data at the click of a button. No longer confined to emails, web-based reports can be packaged, consumed and amended as and when required.

The evolution of SaaS reporting tools …

Saas products (Xero, for example) have standard reporting with minimal tailoring. Enterprise Resource Planning (ERP) systems are often too expensive, complicated, and disproportionate for early-stage businesses.

Historically, once a business required company-wide tailored reporting, implementing an often-expensive cloud-based ERP system was the logical next step. However, this tends to be a challenging undertaking for even the most resolute of early-stage and growing businesses; extracting the most valuable parts of these packages requires specialised knowledge that may not be available in-house.

Related | Why choose Power BI as your business intelligence platform?

How ireport support the FD to become tech-enabled

In our experience, we have found that products like Power BI, can integrate different data sources without the need to transition into using expensive ERP systems.

Using Power BI, we can compile and integrate data from different systems and ensure control remains within the remit of the finance team.

Through ireport, not only have we helped our FDs become tech-enabled, but we have also made these affordable technology and reporting solutions available to our clients and deployed our experienced professionals across a range of exciting projects.

Do not just take our word for it; find out what our ireport clients think

Relator have a look at our Ped article | Project gallery: Take a look at some of our projects

Join us on our socials:

Twitter: @isoscelesfin and @ifdfds

LinkedIn: Isosceles Finance and iFD Part Time FDs and CFOs